|

Issue: March, 2004

Shifting Online Forex Trading Into High

Gear: Not Just for Institutions Any More

by: Elizabeth Thompson Start, stop.

Start, stop. Start, stop. That, in a nutshell, was how I drove my first

stick shift car. After several days of nearly ruining my car’s

transmission, I could release the clutch and press the gas pedal

harmoniously. No more stalling. Soon I could weave that little VW in and

out of traffic like a pro.

Often times, learning how to use

anything that ultimately gives you more control may make you feel almost

out of control at first. Such, too, is true with online systems.

According to Josh Levy, North American head of CMC Group plc,

learning to drive a stick shift is a bit like learning to use CMC’s

Marketmaker, an online forex trading platform (made available to U.S.

traders only since July 2003, after seven years in successful operation

across the pond). The first online forex trading platform kicked into gear

in 1996 and subsequently won, among other awards, the Millennium Product

Award from the U.K. government and the Euromoney award for best

independent non-bank trading platform.

“What anyone who drives

stick will tell you is that it’s kind of harrowing at first, and it’s not

as easy as driving automatic,” says Levy, “but once you get comfortable

with driving stick shift, most manual stick drivers will tell you that it

offers you control, more power, more flexibility and just an overall

better sense of a driving experience. Our customers have told us that our

platform is the same.”

But will American forex traders find that

Marketmaker offers an overall better sense of a forex trading experience

than a more common, but more limited trading platform? If numbers are any

indication, then the answer is yes. Since CMC opened its New York office

last summer, the number of U.S. accounts has increased steadily each

month, according to Levy.

CMC Forex opened for business in the

U.S. as a registered futures commission merchant (putting them under CFTC

oversight) at quite an opportune time, as interest in foreign exchange

trading has grown significantly among retail traders in the last year. But

heightened interest in forex trading probably is not the only reason their

business has seen a boost. They have a lot of products as well as

customizable features and flexible trading sizes through the Marketmaker

platform.

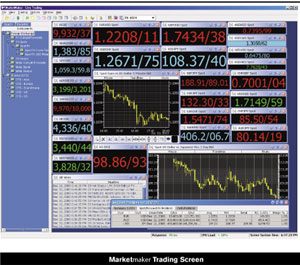

click image for

larger view

This includes more than 300 currency products, such

as commonly traded currencies like the euro and yen, and even more exotic

currencies – the South African rand and the Estonian kroon for starters.

And while many forex dealers offer only spot, or cash currencies, CMC has

currency forwards and swaps under the hood. Says Levy, “We can even trade

a forward that would expire, or that would be set to the same value date

as the currency futures traded in Chicago. For a lot of guys who are used

to trading currency futures, that’s a tremendous advantage.”

Add to

this advantage the fact that Marketmaker users can hedge in exact amounts

rather than just approximations, in essence giving traders more control.

Currency futures traders, for example, typically have to trade in standard

sized lots. That’s just the way futures work, with standardization being

the norm. With Marketmaker, on the other hand, users could trade, for

example, $123,456 to a specified currency.

Before users begin

navigating through forex with exact hedges, they can analyze the market

using market information provided by the platform. Marketmaker offers

users access to integrated charts, news, third-party commentary and

research – all customizable – again giving users more control. For

instance, users can change the size and location of charts and news; they

can choose whether or not to view their open positions and profits and

losses in real time. Also, because these windows are integrated, a user

won’t have to close the trading window to view charts, news or market

commentary. Sure, it may take a while for users to customize their

screens, but once done, they can easily shift their focus from a trade to

news, from news to charts, etc.

But is that more than the average

trader needs? Perhaps, but it could also give the average Joe a leg up

with the opportunity to use a platform suited for professional traders and

skilled individual traders. Levy notes that because Marketmaker is so

sophisticated, it has attracted institutional customers as well as

individuals.

So how can it be suited to non-professionals as well?

“Following the success of the Chicago futures exchanges, CMC recently took

the decision to make available…E-mini-style products, so our minimum

account size in line with the E-mini concept is just $500 now,” explains

Levy.

He adds that because CMC is all-electronic and acts as a

market maker, earning money from its own trades, CMC’s platform is free of

commission fees and other user fees. Thus making it all the more

accessible for virtually all groups of traders – or at least those who

enjoy driving stick.

—

end |